2025 Crypto Tax Subscripton Plan Special: Get 5% Off — Sign Up by May 31 to Save!

Trusted Fort Worth Crypto CPA Services

Fort Worth Investors: Meet Your Crypto Tax Partner

In the heart of Cowtown, where traditional values meet cutting-edge technology, managing your cryptocurrency taxes doesn’t have to be as challenging as taming a wild mustang.

At Chainwise CPA, we blend Texas-sized hospitality with unparalleled crypto tax expertise to help you wrangle your digital assets with confidence.

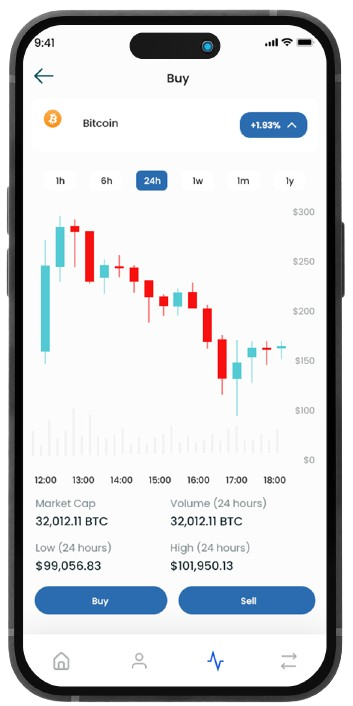

Your Crypto Tax Solutions

Let’s Maximize My Crypto Refund

Whether you’re a crypto miner in Arlington Heights, a DeFi working near Sundance Square, or a blockchain startup in the Near Southside, our team of seasoned CPAs is here to guide you through the complex terrain of cryptocurrency taxation.

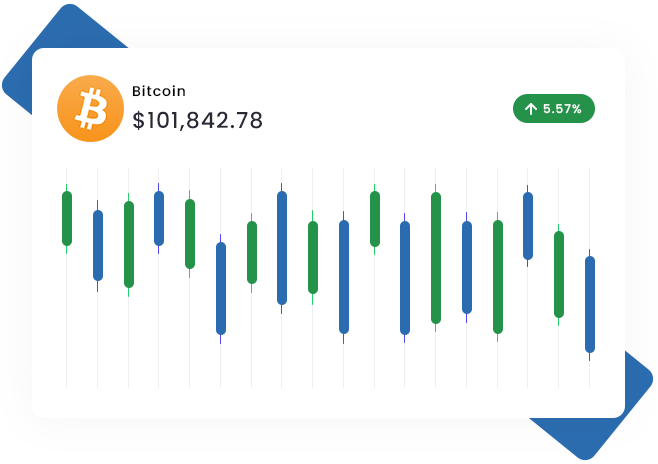

Maximize Your Tax Savings

Keep More Coins with Fort Worth Crypto CPAs

We’re not just CPAs; we’re your neighbors who speak fluent crypto. Our team stays ahead of the latest developments in both local and international crypto regulations, ensuring your taxes are as current as the blockchain itself.

Tax Services

Tailored crypto tax services with personalized deductions, seamless digital filing, and year-round support to minimize your tax burden.

Tax Planning

Expert crypto tax planning for self-employed individuals, executives, and investors, optimizing deductions and entity structures to minimize tax liability and drive better financial outcomes.

Tax Resolution

Specialized crypto tax resolution services, handling IRS/State audits, notices, and disputes to protect your financial security.

Blockchain Bookkeeping

Specializing in crypto bookkeeping and accounting for blockchain startups, we offer software recommendations, transaction reconciliation, and financial reporting for crypto and fiat transactions.

About Us

Why Choose ChainWise CPA?

Chainwise CPA’s local knowledge is a game changer. Our Texas-focused crypto tax professionals keep pace with evolving state-specific regulations. We ensure you remain ahead of changing crypto tax laws, mitigating risks, and leveraging local incentives for maximum financial benefit.

Crypto-Focused Expertise

Our team lives and breathes Funkytown cryptocurrency taxation. We stay ahead of the curve so you don’t have to.

Tailored Solutions

From individual hodlers to large-scale mining operations, we craft personalized tax strategies that fit like a well-worn pair of boots.

Proactive Approach

Our year-round tax planning services help you optimize your crypto investments and minimize liabilities, keeping more of your digital gold in your saddlebags.

What Our Clients Say

Testimonials

Don’t just take our word for it – hear from the crypto enthusiasts and businesses we’ve helped navigate the complex world of cryptocurrency taxation. Our clients’ success stories speak volumes about our expertise, dedication, and the real-world impact of our services.

Besa Z

Excellent Tax Service providers! I worked with Taylor B and Joshua B and they both did a fantastic job reconciling my trades...

Lori

I found [them] through CoinTracking when it came time to do taxes earlier this year. Sharon Yip is a true gem of a person. She was...

Drew McInnes

They are crypto native accountants with decades of tax experience. My experience with them was incredible.

Get Started Today

Get Personalized Tax Planning

Don’t let the IRS catch you off guard. Partner with our crypto CPA team and turn your crypto tax challenges into opportunities for growth and savings.

- A comprehensive review of your crypto portfolio

- Personalized tax strategy recommendations

- Clear answers to your burning crypto tax questions

Take the first step towards crypto tax clarity today!