2025 Crypto Tax Subscripton Plan Special: Get 5% Off — Sign Up by May 31 to Save!

Premier Utah Crypto CPA Team

Crypto Taxes Made Easy: Utah’s Trusted CPA for Digital Assets

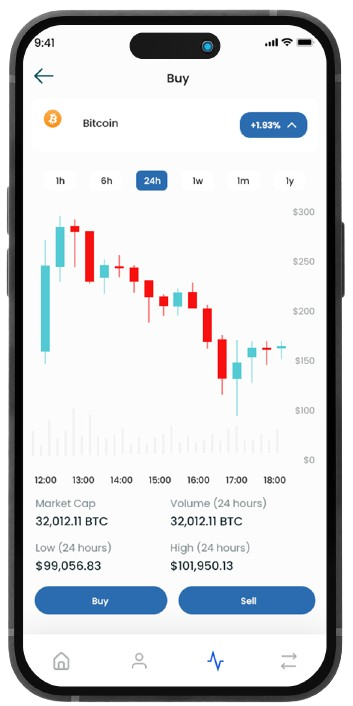

Crypto taxation can be complicated, but with the right CPA, it doesn’t have to be. Whether you’re trading Bitcoin in Salt Lake City, mining Ethereum in Provo, or running a blockchain startup in Park City, Chainwise CPA is here to help.

We specialize in crypto tax compliance, IRS reporting, and business accounting, ensuring Utah investors and entrepreneurs stay ahead of tax laws while maximizing their financial opportunities.

Smart Crypto Tax Solutions

Expert Crypto Tax Help for Utah Investors

Crypto taxation is our specialty. We stay on top of evolving regulations to provide accurate, strategic tax solutions for Utah investors and businesses. Whether you’re an investor, trader, or business owner, we’ll help you save money, reduce tax stress, and stay compliant.

Transform Your Crypto Tax Strategy

Comprehensive Crypto Tax & Accounting Services in Utah

At Chainwise CPA, we blend in-depth knowledge of Utah’s unique tax landscape with cutting-edge understanding of cryptocurrency regulations.

Our mission is to transform complex crypto tax scenarios into clear, compliant strategies that optimize your digital investments while ensuring full adherence to state and federal tax laws.

Tax Services

Tailored crypto tax services with personalized deductions, seamless digital filing, and year-round support to minimize your tax burden.

Tax Planning

Expert crypto tax planning for self-employed individuals, executives, and investors, optimizing deductions and entity structures to minimize tax liability and drive better financial outcomes.

Tax Resolution

Specialized crypto tax resolution services, handling IRS/State audits, notices, and disputes to protect your financial security.

Blockchain Bookkeeping

Specializing in crypto bookkeeping and accounting for blockchain startups, we offer software recommendations, transaction reconciliation, and financial reporting for crypto and fiat transactions.

About Us

Why Choose ChainWise CPA?

In the ever-evolving world of cryptocurrency, staying compliant with tax regulations can feel like solving a complex puzzle. But why navigate these choppy waters alone when you can have a seasoned expert by your side?

Crypto-Focused Expertise

Our team maintains an in-depth understanding of Utah's evolving crypto regulations, positioning us at the forefront of compliance and strategy in the state's digital asset landscape.

Tailored Solutions

We offer customized tax strategies that cater to the diverse needs across Utah, from the urban centers of the Wasatch Front to the state's rural communities.

Ongoing Advisory Support

Our commitment extends beyond tax season, providing year-round guidance to ensure your crypto portfolio remains optimized and compliant with Utah's tax requirements.

What Our Clients Say

Testimonials

Our clients’ experiences speak to our expertise and dedication. Here are insights from some of the country’s leading crypto investors and businesses we’ve had the privilege to serve.

Besa Z

Excellent Tax Service providers! I worked with Taylor B and Joshua B and they both did a fantastic job reconciling my trades...

Lori

I found [them] through CoinTracking when it came time to do taxes earlier this year. Sharon Yip is a true gem of a person. She was...

Drew McInnes

They are crypto native accountants with decades of tax experience. My experience with them was incredible.

Get Started Today

Reduce Your Crypto Tax Burden with Utah’s Top CPA Firm

Your cryptocurrency endeavors in Salt Lake City and throughout Utah deserve expert financial guidance. Let Chainwise CPA be your trusted partner in navigating the complexities of digital asset taxation.

- A comprehensive review of your crypto portfolio

- Personalized tax strategy recommendations

- Clear answers to your burning crypto tax questions

Take the first step towards crypto tax clarity today!