As more people get involved in crypto, scammers have unfortunately followed the money. The fast-paced and often anonymous nature of blockchain technology makes it an appealing environment for fraudsters. Whether you’re new to crypto or a seasoned investor, it’s essential to stay alert to the common tactics scammers use.

Below are some of the most frequent crypto scams and phishing schemes we see, along with red flags that should make you think twice before clicking, investing, or sending funds.

🚩 Red Flag #1: Guaranteed Returns or Very High Interest Rates

If someone promises you a guaranteed return on a crypto investment, especially one that sounds too good to be true, it most likely is. Crypto markets are inherently volatile, and no one can promise consistent profits. Be especially wary of:

- Platforms offering daily or weekly returns like “3% per day”

- Claims like “double your Bitcoin in 48 hours”

- Investment clubs or “staking” opportunities with unrealistic APYs

Legitimate opportunities may involve risk, but scams hide risk entirely and emphasize only the reward.

I want to share a personal story that happened when I first started to invest in crypto more than 7 years ago. The crypto world was a wild west at that time. Just like many new crypto investors, I fell for a Bitcoin Multiplier program that promised 20% return per month. It turned out to be a Ponzi scheme. I lost over $50K investment in less than a year. It was an embarrassing and painful experience for me. That’s also why now when prospects and clients tell me about their suffering from crypto scrams, I can totally sympathize.

🚩 Red Flag #2: “Tax Withholding” or “Fee” Required Before Withdrawal

A growing number of victims report being told they must pay a “tax,” “processing fee,” or “unlock fee” before they can withdraw funds from a platform or investment.

This is a major red flag.

Scammers may even provide fake IRS or tax authority documents to make the request seem official. In reality, they’re just trying to squeeze more money from you. Legitimate investment platforms do not require upfront payments to access your funds, and the IRS does not collect taxes through crypto apps or via direct payment requests.

From time to time, I received emails from prospects seeking advice about how to handle “tax withholding” they are required to pay before they can withdraw their investment in a crypto program. Just like I predicted, every single time it turned out to be a scram. Read the investment program details carefully before you put in any money. Every time when you see a requirement to pay “tax withholding”, walk away.

🚩 Red Flag #3: Impersonation of Legitimate Companies or Professionals

Phishing scams often come in the form of emails, DMs, or even fake websites that appear to be from trusted crypto platforms, wallet providers, or well-known figures. These may include:

- Fake customer service asking for your private keys or seed phrase

- Emails with urgent language asking you to “verify your account”

- Links to phishing websites that look almost identical to the real ones

Remember: no legitimate platform or professional will ever ask you for your private keys or seed phrase. Ever.

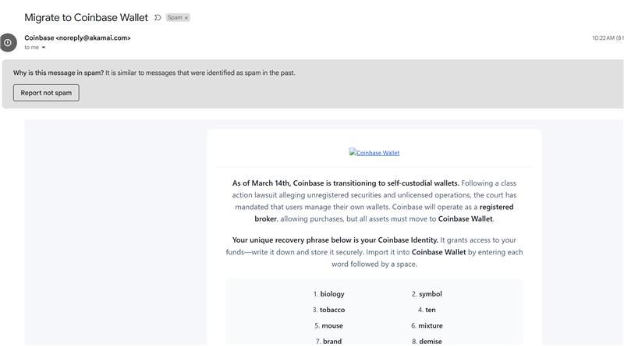

Recently, I received the following email, seemingly from Coinbase. Based on my personal and professional experience in crypto from the past 8 years, I knew right away that it’s a fake/phishing email. However, some less experienced crypto investors might fall for it. Our friendly reminder: always check the full email address of the sender and pay attention to details. Some email addresses look legitimate on the surface, but you will see some small differences if you look closer.

🚩 Red Flag #4: Social Engineering on Messaging Apps or Social Media

Scammers often build trust by engaging you in conversation, either through direct messages on social platforms or encrypted messaging apps. Common tactics include:

- Pretending to be a crypto “coach” or “advisor”

- Offering to teach you how to make profits quickly

- Inviting you into a group with fake success stories and screenshots

They may even show you a dashboard with “your growing balance”, but when it’s time to withdraw, you’ll find that they suddenly disappear.

A real story – last year a prospect contacted me and asked me to help with tax planning because he was expecting to realize over $1.5M of capital gains in crypto soon. It turns out a few months ago, he joined a Telegram group that was led by a “big name” crypto guru who’s launching a new token that “guaranteed” to be a huge success. The prospect took out $300K from a Home Equity Line of Credit to invest in the token. I knew right away that most likely was a scam. I recommended that he withdraw his investment as soon as possible. On the date of the token launch, I got an email from the prospect. He said the Telegram group suddenly disappeared, and he couldn’t access his investment account anymore. I felt sorry for him. It’s a huge price to pay, especially since he’s using money from a loan.

🚩 Red Flag #5: Pressure to Act Fast

Scams often create a false sense of urgency. You may be told that:

- An opportunity is only available for a limited time

- You must act now or miss out (FOMO)

- A “bonus” or reward will expire soon

This is a tactic to rush you into a decision without doing proper research. Anytime someone is pressuring you to act immediately, think twice before you put in any money. It’s always better to be safe than sorry.

💡 Stay Safe: Tips to Protect Yourself

- Verify links and URLs. Don’t click on links in unsolicited emails or messages.

- Use official websites. Bookmark the official sites of any crypto services you use.

- Enable two-factor authentication (2FA). This adds an extra layer of security to your accounts.

- Do your own research (DYOR). Check whether the company or person is legitimate before investing or sharing information. Do not blindly follow the crowd and let FOMO get to you.

- Talk to someone. If you’re unsure, bounce the situation off a trusted friend or professional.

Crypto is an exciting and rapidly evolving space—but that also means it’s a playground for bad actors. Staying informed and cautious is the best defense. When in doubt, take a step back, do some digging, and remember: if it sounds too good to be true, it most likely is.