2025 Crypto Tax Subscripton Plan Special: Get 5% Off — Sign Up by May 31 to Save!

Leading Washington Crypto CPA

Your Go-To Washington Crypto CPA for Taxes & Compliance

Navigating crypto taxes in Washington doesn’t have to feel like summiting Mount Rainier. From personalized deductions to seamless digital filings, our Washington Crypto CPA team offers year-round support to lighten your tax load.

We specialize in tax planning for self-employed Washingtonians, executives, and investors, ensuring your deductions shine brighter than a Puget Sound sunset while keeping your finances IRS-compliant.

Schedule a Call

Ready for Stress-Free Crypto Taxes?

Facing an IRS notice or audit? Our Washington Crypto CPA crew provides specialized tax resolution services to tackle disputes and audits with confidence. We represent you against federal and state agencies, safeguarding your financial peace of mind amidst Washington’s rugged regulatory terrain.

Blockchain Tax Services for Washington

Top Washington Crypto CPA Services

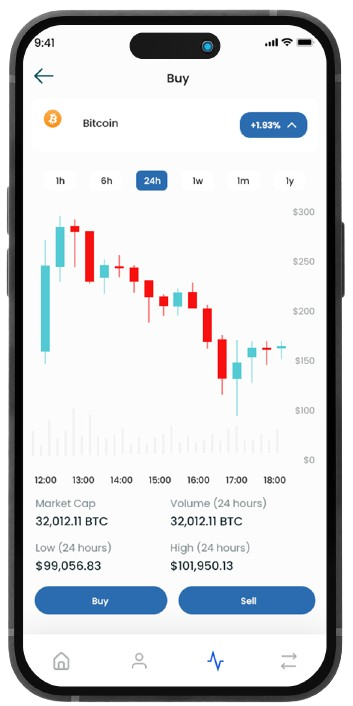

The IRS has ramped up enforcement of crypto tax compliance, and Washington investors need specialized support to avoid costly mistakes. We specialize in helping Washington individuals and businesses manage their crypto tax obligations with precision and ease. Our crypto CPA services include:

Tax Services

Tailored crypto tax services with personalized deductions, seamless digital filing, and year-round support to minimize your tax burden.

Tax Planning

Expert crypto tax planning for self-employed individuals, executives, and investors, optimizing deductions and entity structures to minimize tax liability and drive better financial outcomes.

Tax Resolution

Specialized crypto tax resolution services, handling IRS/State audits, notices, and disputes to protect your financial security.

Blockchain Bookkeeping

Specializing in crypto bookkeeping and accounting for blockchain startups, we offer software recommendations, transaction reconciliation, and financial reporting for crypto and fiat transactions.

Washington Crypto Accounting Team

Your Best Choice for Crypto Tax Services

As Washington’s trusted crypto tax professionals, we combine deep knowledge of digital assets with tax expertise to provide strategic solutions. Here’s why our clients choose us:

Crypto Expertise

Our team lives and breathes Washington cryptocurrency taxation. We stay ahead of the curve in this tech-savvy state, so you don't have to.

Tailored Solutions for WA

Whether you're an individual investor in Seattle or a crypto business in Tacoma, we craft strategies that fit your unique Washington needs.

Proactive Approach

We don't just react to tax seasons – we help you plan year-round to optimize your crypto investments and minimize tax liabilities in Washington's dynamic market.

Your Crypto Success Stories Start Here

Testimonials

Don’t just take our word for it—hear from Washington crypto fans and businesses we’ve guided through the tax wilderness. Their victories highlight our expertise and dedication, proving our real impact across the Evergreen State.

Besa Z

Excellent Tax Service providers! I worked with Taylor B and Joshua B and they both did a fantastic job reconciling my trades...

Lori

I found [them] through CoinTracking when it came time to do taxes earlier this year. Sharon Yip is a true gem of a person. She was...

Drew McInnes

They are crypto native accountants with decades of tax experience. My experience with them was incredible.

Ready To Get Started?

Partner with Your Washington Crypto CPA Today

With cryptocurrency regulations constantly evolving, having a knowledgeable Washington Crypto CPA is essential. We simplify the process, helping you navigate tax season with confidence and peace of mind.

Schedule a consultation today and ensure your crypto taxes are handled by the experts.

- A comprehensive review of your crypto portfolio

- Personalized tax strategy recommendations

- Clear answers to your burning crypto tax questions

Take the first step towards crypto tax clarity today!