2025 Crypto Tax Subscripton Plan Special: Get 5% Off — Sign Up by May 31 to Save!

Premier Texas Crypto Tax Accountant

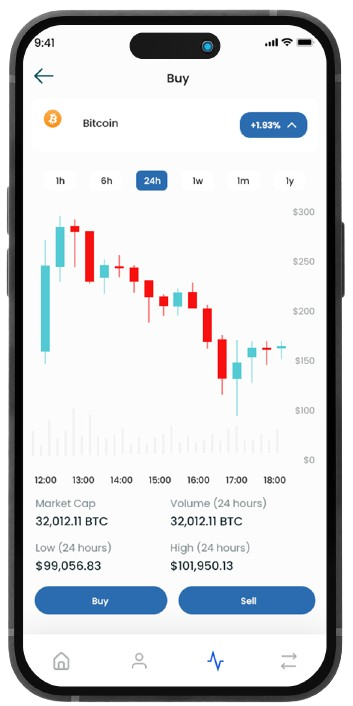

Simplify Your Crypto Taxes in the Lone Star State

In a state where everything’s bigger, your crypto investments shouldn’t lead to oversized tax headaches. With Chainwise CPA, navigating the complex world of cryptocurrency taxes in Texas becomes as smooth.

Schedule your free inquiry today and discover how our Texas crypto tax accountant team can make your situation seamless and stress-free for you or your business.

Your Texas Crypto Tax Solution

Tailored Tax Services for Texas Residents

At Chainwise CPA, we’re not just number crunchers – we’re your strategic partners in the booming Texas crypto scene. Our mission? To demystify crypto taxes for Texans and empower you to make informed financial decisions that fuel your success in the Lone Star State.

A Trusted Texas Crypto Tax Accountant Team

Transform Your Crypto Tax Strategy

Navigating cryptocurrency taxes in Texas’ diverse financial landscape can be as challenging as roping a wild steer, but it doesn’t have to be. We specialize in helping Texas individuals and businesses manage their crypto tax obligations with precision and ease.

Whether you’re an oil tycoon turned crypto investor in Houston, a tech startup in Austin, or a rancher dabbling in digital assets, our team of experienced Texas crypto CPAs is here to simplify the process and maximize your savings.

Tax Services

Tailored crypto tax services with personalized deductions, seamless digital filing, and year-round support to minimize your tax burden.

Tax Planning

Expert crypto tax planning for self-employed individuals, executives, and investors, optimizing deductions and entity structures to minimize tax liability and drive better financial outcomes.

Tax Resolution

Specialized crypto tax resolution services, handling IRS/State audits, notices, and disputes to protect your financial security.

Blockchain Bookkeeping

Specializing in crypto bookkeeping and accounting for blockchain startups, we offer software recommendations, transaction reconciliation, and financial reporting for crypto and fiat transactions.

About Our Crypto CPA Firm

Why Choose ChainWise CPA in Texas?

In the fast-paced world of cryptocurrency, keeping up with Texas’ unique tax regulations can feel overwhelming. But don’t worry—you don’t have to tackle these challenges by yourself! Having a friendly and knowledgeable Texas crypto tax accountant by your side can make the process a lot easier and more enjoyable.

Texas Crypto Expertise

Our team lives and breathes Texas cryptocurrency taxation. We stay ahead of the curve in this energy and tech hub, so you don’t have to.

Tailored Solutions for Texans

Whether you’re an individual investor in Dallas or a crypto business in San Antonio, we craft strategies that fit your unique Texas needs.

Proactive Approach

We don’t just react to tax seasons – we help you plan year-round to optimize your crypto investments and minimize tax liabilities in Texas’ dynamic market.

What Our Clients Say

Testimonials

Don’t just take our word for it – hear from the Texas crypto enthusiasts and businesses we’ve helped navigate the complex world of cryptocurrency taxation in the state. Our clients’ success stories speak volumes about our expertise, dedication, and the real-world impact of our services in the heart of Texas.

Besa Z

Excellent Tax Service providers! I worked with Taylor B and Joshua B and they both did a fantastic job reconciling my trades...

Lori

I found [them] through CoinTracking when it came time to do taxes earlier this year. Sharon Yip is a true gem of a person. She was...

Drew McInnes

They are crypto native accountants with decades of tax experience. My experience with them was incredible.

Get Started Today

Ready to Take Control of Your Crypto Taxes

Think of your Texas crypto tax journey as more than just a series of transactions – it’s a powerful tool to grow your financial future in one of America’s most dynamic economies. Let ChainWise CPA be the catalyst that transforms your Texas crypto tax challenges into opportunities.

- A comprehensive review of your crypto portfolio

- Personalized tax strategy recommendations

- Clear answers to your burning crypto tax questions

Take the first step towards crypto tax clarity today!